The S&P 500 is currently sitting at a new all-time high. The index is up more than 20% this year, after gains of 18% and 31% the last two years. Not bad. We haven’t even had a correction of more than 5% since last November. It’s never been a better (or easier) time to be a stock investor.

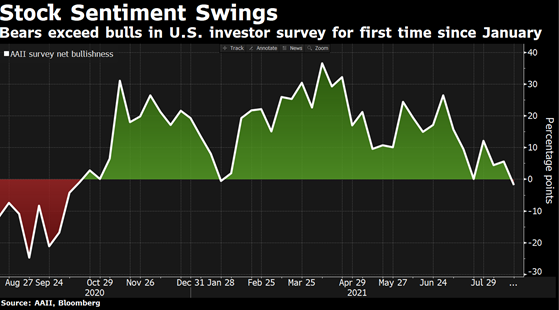

And yet, stock investors are feeling depressed. The chart below shows market sentiment over the last year, and for the first time since January, more investors expect the market to fall than for the market to rise. In other words, despite stellar returns and low volatility, there are now more bears than bulls.

How can this be? If investors are growing more bearish, how does the stock market keep rising? The answer is that the S&P 500 isn’t the whole stock market. Not even close. It’s a concentrated index led by five big technology firms. Despite all-time highs in the S&P 500, fewer and fewer stocks have been behind that rally.

In other areas, there are growing signs that investors are beginning to take cover.

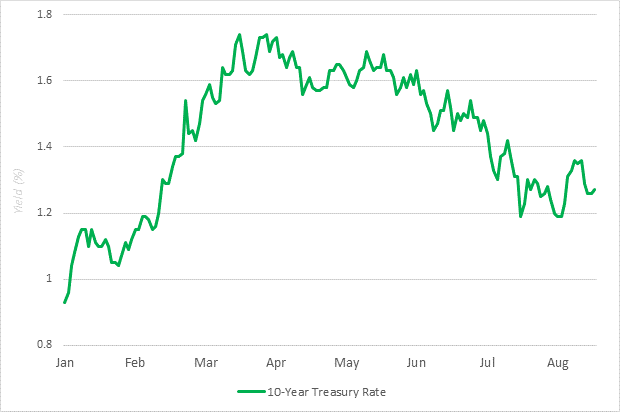

Let’s start with bonds. Despite the threat of higher inflation, bond yields have been declining for months. Why? Buying bonds is generally thought of as a “flight to safety.”

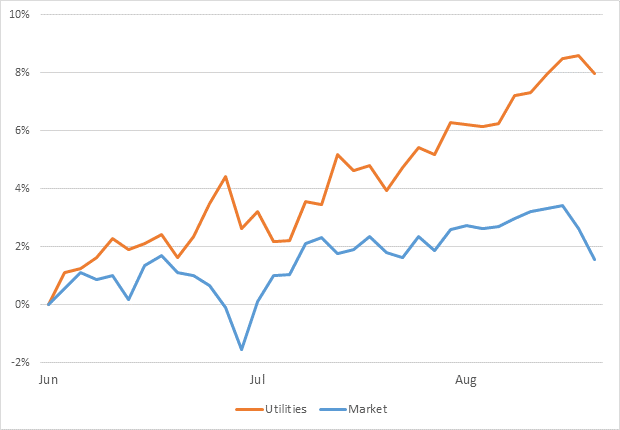

Next, let’s look at Utilities. This sector, with regulated monopolies, is considered one of the “safest” bets in the stock market. The chart below shows that these “safe” stocks have been outperforming the overall market over the past few months. Not what you would expect against the backdrop of a supposedly strong economy.

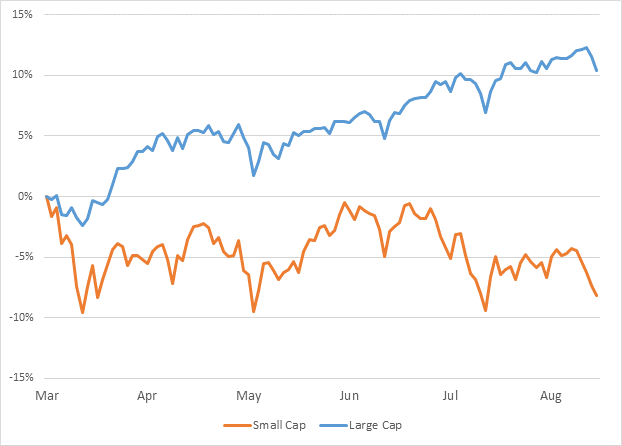

Then there are small caps. Small caps tend to outperform large caps when investor appetite for risk is high, usually when economic growth is strong. Despite a rebounding economy and strong recent jobs reports, small caps have badly underperformed large caps since the start of this year.

Finally, Emerging Markets, another “risk on” asset class (like small caps), has also underperformed significantly this year. Is favoring the U.S. another sign of a “flight to safety”?

So what does this rising skepticism mean for the stock market in the months ahead? Surprisingly, it may end up being a positive. Skepticism means cash is still on the sidelines, and that there are still buyers left to move the market higher. If all investors were bulls, all the money would already be in the market, and we’d have nowhere to go but down.

Deprecated: preg_replace(): Passing null to parameter #3 ($subject) of type array|string is deprecated in /home/ogorek_dev_minerva/ogorek.minervawddev.com/wp-includes/kses.php on line 1805

PLEASE SEE IMPORTANT DISCLOSURE INFORMATION HERE.

Comments:

Mike Schwimmer August 24 2021