Deprecated: preg_replace(): Passing null to parameter #3 ($subject) of type array|string is deprecated in /home/ogorek_dev_minerva/ogorek.minervawddev.com/wp-includes/kses.php on line 1805

Nervous About The Markets?

Protecting Your Money

1. We Don’t Sell Anything

You’re looking for an advisor who puts your interests first. As fiduciaries, we are legally required to act in your best interest at all times. That means we don’t sell you products (insurance, annuities, or mutual funds), we don’t earn commissions, and investment decisions are based entirely on their merit.

2. Low Expenses

The lower your investment expenses, the more you earn. We make a concerted effort to keep investment expenses as low as practicable. High expense mutual funds and exchange traded funds (ETFs) need not apply.

3. Charles Schwab

You want to know that your money is safe. We have a more than 35 year relationship with Charles Schwab as our independent third-party custodian. With your money housed at Charles Schwab, no funds are moved in/out of your accounts without your approval.

Eliminating The Clutter

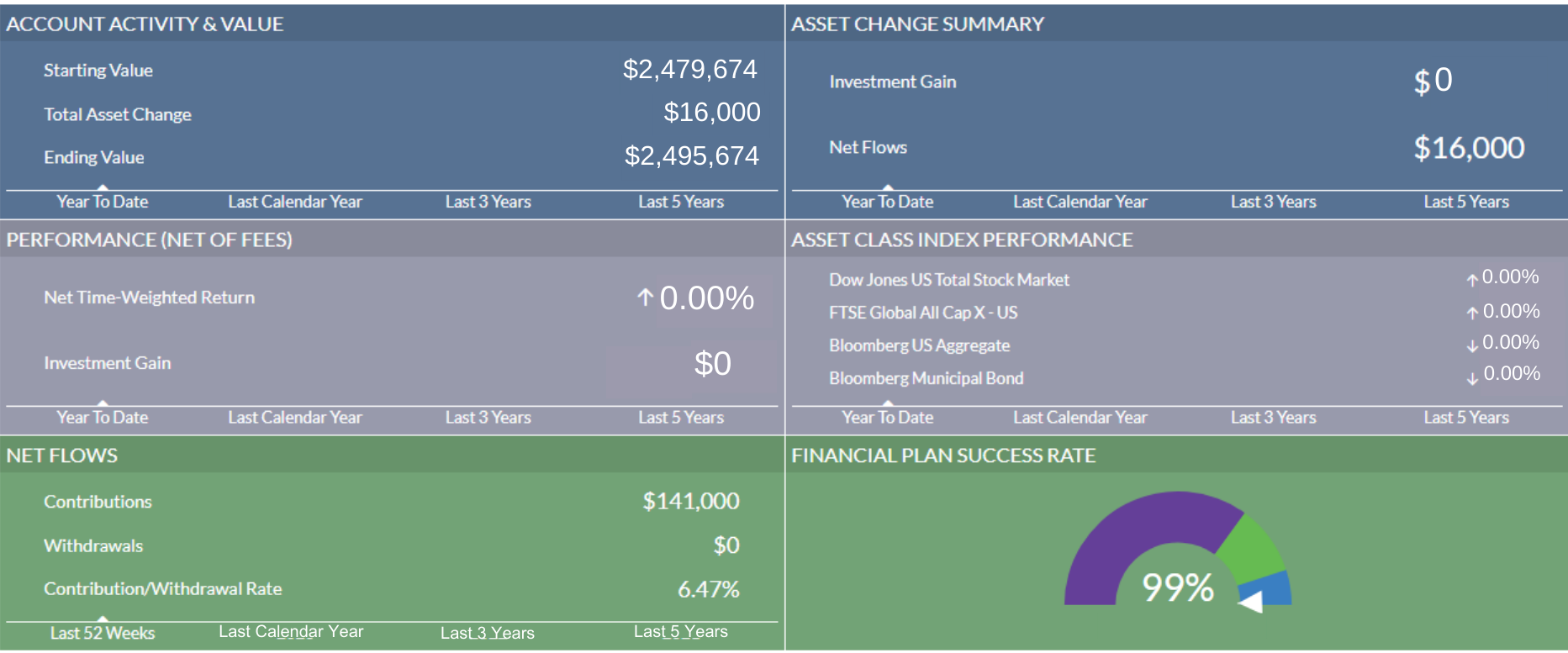

We offer a personalized, easy to view, meaningful alternative we refer to as your CLIENT DASHBOARD. Here you can view a summary of investment holdings, such as your 401(k) IRA’s and brokerage accounts all in one place. Our custom smartphone app allows you to access your CLIENT DASHBOARD with the touch of a finger.