If the Financial Crisis ushered in the era of “ultra-low” interest rates, the current pandemic took it a step further to bring about “near-zero” interest rates. Forget about earning a decent return on bonds. 10-year Treasury bonds currently yield just 0.85% and investment-grade corporate bonds pay just 1.75%. Short-term bonds and cash pay next to nothing.

Individual investors have long counted on bonds to produce income for their retirement. But the world has changed, and the Federal Reserve has forecasted rates to stay near-zero through at least 2023 (it could be worse as some countries, such as Germany, have negative interest rates). What should investors do when bonds no longer generate any meaningful income?

Let’s start with what not to do: Don’t take on more and more risk.

The chart below shows bond yields pre-Financial Crisis (2007) versus Today. The differences are striking. At the start of 2007, 10-year Treasury bonds yielded 4.7%. To earn that same yield today, you would need to buy not risk-free Treasury bonds, but instead risky high-yield corporate bonds, rated as low as single “B.” These bonds are otherwise known as “junk bonds.”

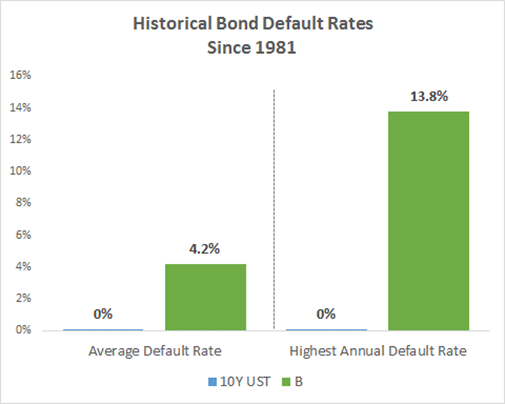

What does that mean for investors? It means the bonds have a high risk of default. While Treasury bonds have zero default risk (backed by the full faith and credit of the U.S. Government), bonds rated single “B” have an average annual default rate of 4.2% over the last 40 years. The highest single-year default rate was nearly 14%. In other words, buyer beware. What good is the promise of a higher yield today, if the bond defaults tomorrow?

Take these steps instead to increase the income potential of your portfolio:

- Reduce Expenses – According to Morningstar, more than three-quarters of actively managed corporate bond funds underperformed their benchmark in 2019. Actively managed funds are expensive (usually 0.50% or more), which reduces the yield. Opt for passively-managed index funds instead, which are available at a fraction of the cost.

- Reduce Taxes – Municipal bond index funds currently have almost the exact same yield as taxable bond index funds, plus you won’t pay any federal tax on municipal bond interest. Adding high-quality municipal bonds to your taxable accounts may be a smart way to increase your after-tax income. After all, it’s not what you earn, it’s what you keep.

- High Dividend Stocks – Dividend yields on stocks haven’t been this high relative to Treasury bond yields in at least 45 years. While avoiding dividend traps often found in energy firms and even banks, many highly profitable companies are available with yields close to 3%. Dividend stocks are not bonds, and are not immune to stock market declines. However, we think the extra return potential from allocating a small portion of your bond portfolio to dividend stocks (5-10%) is worth the added volatility in this case.

Lastly, while bond investors tend to focus exclusively on income potential, remember, bonds serve another perhaps more important purpose: diversification. In other words, bonds aren’t stocks, and when the stock market falls, high-quality bonds tend to hold, if not increase their value.

We think making these small changes can increase the income potential of your portfolio while maintaining much needed diversification.

Deprecated: preg_replace(): Passing null to parameter #3 ($subject) of type array|string is deprecated in /home/ogorek_dev_minerva/ogorek.minervawddev.com/wp-includes/kses.php on line 1805

PLEASE SEE IMPORTANT DISCLOSURE INFORMATION HERE.