In the midst of the financial crisis of 2008-2009, the Federal Reserve lowered interest rates to near-zero in an attempt to save the economy from collapse. Having staved off disaster, the Fed was unable to begin raising rates again until 2017-2018 (and then, very slowly).

This decade-plus of low rates devastated savers and had a profound impact on the way people invested their money. Cash, long seen as an important asset class in a diversified portfolio (earning 3-5% pre-crisis), now paid next to nothing as did the stalwarts of a well-rounded bond portfolio, namely treasury bonds and mortgage backed securities. These low returns on two traditional asset classes caused investors to flock to two very different ones: high yield debt (otherwise known as junk bonds) and stocks. It was no surprise that the past decade was one of the best for stocks (and other risky assets) in history.

However, we are now seeing the downside to a decade of low rates:

- As the stock market is falling, investors do not have the traditional cash buffers seen during previous downturns. In fact, many people (and companies) have taken on more debt than ever before (enticed by the low rates) and now will face an even greater challenge.

- Bond investors that stretched for yield and bought junk bonds are now paying the price: junk bonds are down nearly just as much as stocks (we have purposefully avoided junk bonds in your portfolio).

- The traditional inverse relationship between even high quality bonds and stocks is breaking down.

This last point requires some further explanation. At the point the Federal Reserve lowered interest rates to near-zero in 2008-2009, the 10 year treasury bond was yielding 5%. This significant drop in rates caused high-quality bonds to substantially increase in value (bond prices go up when interest rates fall). This large increase in the price of bonds helped to cushion the drop in stocks during the financial crisis. In other words, bond prices acted as they were supposed to do: offering positive returns when stocks were tanking.

However, this is not what is happening today. When the Fed cut rates to near-zero this weekend (to counteract the impact of the Coronavirus on the economy), rates on the 10 year Treasury bond were just 1.5%. A 1.5% decline to 0% is a lot less than a 5% decline during the financial crisis. In other words, Today bonds have given up at least 3.5% of positive returns relative to the financial crisis.

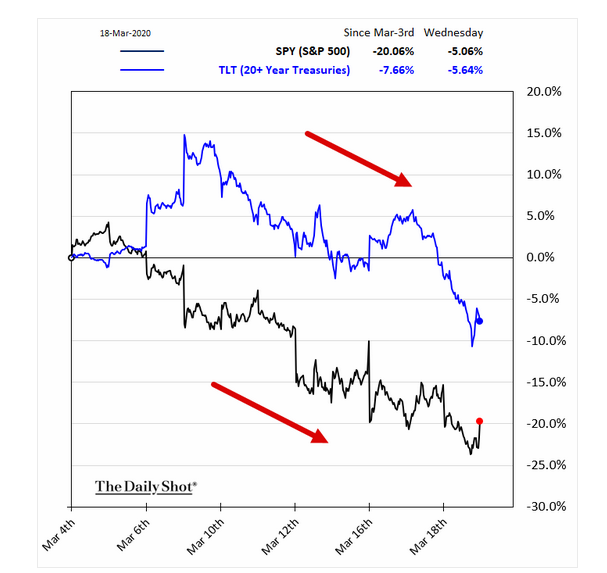

As a result, the traditional relationship of bonds moving inversely to stocks has broken down, with bonds no longer providing the price gains when you most need them. The chart below illustrates this point, comparing the price return of 20-year Treasury bonds (in blue) and stocks (black) during the last few weeks. Historically, these two assets classes have moved inversely to each other (especially in times when stocks have moved strongly in one direction or another). These past few weeks, they’ve both been down. More intermediate-term bonds (5-7 years), where we tend to invest, are roughly even on the year.

So why do we still hold bonds in your portfolio? While bonds are not providing meaningful gains during this crisis, they are holding their value and continue to provide some much needed income. This has made the losses this week much more palatable as we wait for stocks to eventually reach their bottom.

If you have any questions or concerns we are here. Please contact us or schedule an appointment.

Deprecated: preg_replace(): Passing null to parameter #3 ($subject) of type array|string is deprecated in /home/ogorek_dev_minerva/ogorek.minervawddev.com/wp-includes/kses.php on line 1805

PLEASE SEE IMPORTANT DISCLOSURE INFORMATION HERE.