In 2020, Moog created a new retirement plan called the RSP+ account. The plan consists of a company match on employee 401(k) contributions, and an additional annual direct contribution by Moog. Importantly, Moog’s retirement plan no longer has a pension option. This means all the market risk is borne by the employees, which makes it vital that retirement dollars are invested wisely.

How does the Moog 401(k) match work?

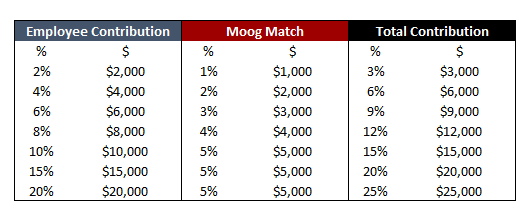

Starting October 1, 2021, Moog will match 50% of the first 10% of eligible pay that employees contribute to their 401(k) account. In other words, employees contributing 10% or more of their salary will receive the full 5% match.

The below table shows the matching amounts received for a Moog employee making $100,000 per year:

How is my 401(k) invested?

The default option for Moog 401(k) accounts (including the company match) is the Blackrock Life Path funds. These funds are similar to other target-date retirement funds, and hold both stocks and bonds.

Your default Blackrock Life Path fund depends on your age. For instance, a 30 year-old Moog employee will likely be assigned the 2055 fund (the closest year to which the employee turns 65). A 55 year-old Moog employee, on the other hand, will likely be assigned the 2030 fund.

The funds differ in their risk exposure, with the funds designed for younger employees (with target retirement dates further out into the future) with more exposure to stocks (and less to bonds). Conversely, funds designed for older employees have greater exposure to bonds (and less to stocks).

Are the Blackrock Funds good investments? Do I have other options?

While you do have many other options (including several Vanguard funds) we think the Blackrock funds are perfectly suitable while you are still working. It’s worth noting that roughly half of all 401(k) dollars at Moog are invested in the Blackrock Life Path funds.

Pros:

- Simplicity – While you can replicate 90% of the investment strategy using various Vanguard funds in your 401(k), the Blackrock funds offer the simplicity of a single investment choice. In addition, the funds automatically reduce your exposure to the stock market as you get closer to retirement.

- Relatively Low Fees – Blackrock Life Path charges 0.09% per year, or $9 per $10,000 invested. While Vanguard funds are slightly cheaper (as low as 0.03%), you would have to invest in several to replicate the all-in-one stock/bond mix offered by Blackrock.

- Only option for exposure to REITs, TIPS – Moog’s 401(k) lineup in bonds/alternative investments is very weak. For instance, you have only two bond funds to choose from (versus 11 stock funds). As a result, the Blackrock Life Path fund do offer some exposure you can’t get elsewhere, including to Real Estate Investment Trusts (REITs) and Treasury Inflation-Protected Securities (TIPS).

While Blackrock Life Path funds are a perfectly suitable choice within the confines of Moog’s 401(k) plan, we think better options may exist outside Moog’s plan.

Cons:

- Not Actively Managed – Blackrock Life Path is made up of index funds designed to track the overall market. In other words, Blackrock does not buy individual bonds or stocks in an attempt to gain an advantage.

- Not Built for Today’s Low Rate Environment – Blackrock Life Path leans heavily on a bond-index that pays just 1.25% per year (this funds is more than 50% of the Blackrock Life Path Retirement Fund), below the inflation rate.

- Benchmark Performance – Blackrock Life Path generates market performance (i.e. the stock market falls 20%, your stocks fall 20%). There is no opportunity to decrease risk as conditions warrant.

If you are a Moog employee and are currently thinking about retirement, we have a plan for you. Ogorek Wealth Management (based in Buffalo, NY) specializes in managing wealth and building retirement plans for Moog employees. We are experts in your benefits plans and will work to give you a seamless transition into retirement.

Learn more about Ogorek Wealth Management and our unique approach by scheduling a time to meet.

Gain comfort in one of the most important decisions in your life.

Deprecated: preg_replace(): Passing null to parameter #3 ($subject) of type array|string is deprecated in /home/ogorek_dev_minerva/ogorek.minervawddev.com/wp-includes/kses.php on line 1805

PLEASE SEE IMPORTANT DISCLOSURE INFORMATION HERE.