There is no doubt that President Trump faces an uphill election battle.

For starters, the President lost the popular vote by nearly three million votes in 2016, and carried the electoral college only with wins in Pennsylvania, Wisconsin and Michigan, which he won by a combined margin smaller than the capacity of a college football stadium (pre-pandemic, of course). Re-election was always going to be an uphill battle.

And then the Pandemic hit. While still seen as better for the economy than Biden (no small point), the country is currently suffering through a recession, with more than 8% unemployed. No President since 1948 has retained the White House with either a recession or correction in the stock market in the last two years of his presidency (we’ve had both this year).

Polls seem to support this view. RealClearPolitics shows Biden with a 6.5 point edge nationally, and currently leading in the battleground states of Florida, Ohio, Pennsylvania, Michigan, Wisconsin, Arizona and others. If we are to believe the polls, the President is in trouble.

But what is the stock market saying? Isn’t the stock market the ultimate gauge of current sentiment, and constantly pricing in all available information?

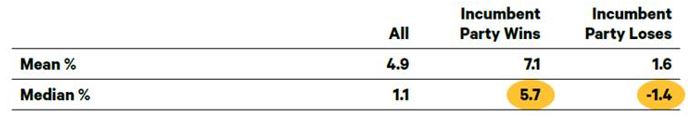

The chart below shows an unusual predictor of whether the incumbent party will retain the White House. When the incumbent party wins, the stock market tended to rally between the end of the second convention and election day (with a median gain of 5.7%). When the incumbent party loses, the stock market tended to fall during that same time period (with a median drop of 1.4%).

This indicator (using the stock market’s performance just before the election to predict the winner) correctly predicted a Trump win in 2016. Since 1928, the stock market’s performance has correctly predicted the winner a staggering 87% of the time.

Dow Jones Industrial Average Performance (end of second convention through election day)

Source: Ned Davis Research

So where do we stand this year? While there are still 43 days until the election, the stock market is currently down nearly 6% since the last day of the Republican convention on August 27th. If this continues, history suggests a Trump loss.

In our next blog piece, we’ll discuss how we’re preparing for the election, and possible winners and losers from both a Biden or Trump win.

While this election will clearly be anything but predictable, we think the stock market will continue to offer some clues for election day.

Deprecated: preg_replace(): Passing null to parameter #3 ($subject) of type array|string is deprecated in /home/ogorek_dev_minerva/ogorek.minervawddev.com/wp-includes/kses.php on line 1805

PLEASE SEE IMPORTANT DISCLOSURE INFORMATION HERE.