The argument against holding gold has long been that it doesn’t pay you anything. No interest or dividends. You are buying it simply in the hopes that someone will be willing to pay you a higher price for it down the road.

But now, some bonds don’t pay you anything either. After adjusting for inflation, treasury bonds are poised to have negative real returns over the next decade. While a 10-year treasury bond still yields roughly 0.6% per year, inflation is expected to be 1.5% per year over the next ten years. In terms of purchasing power (what we mean by real return), you will actually be worse off in ten years than today. That’s not much of an investment.

Gold on other hand, while still paying you nothing, has the potential to rise along with inflation. At the very least, your purchasing power should be protected.

And we think there may be the potential for gold prices to rise by even more than that.

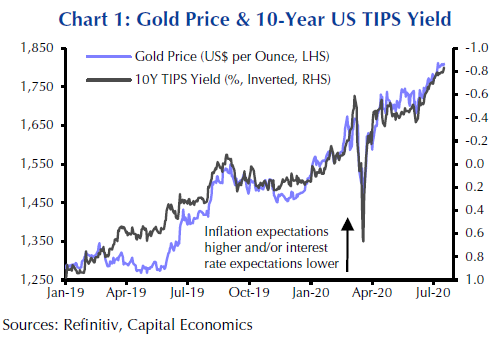

The chart below shows how gold prices (light blue line) rise when real bond returns (black line) fall. Real bond returns are shown as inverted (rising when they are actually falling), so the trend can be seen more clearly.

The conclusion is clear. When real bond returns fall (either interest rates go down, or inflation goes up), gold prices rise. And we think real bond returns could fall further. First, interest rates aren’t moving higher since the Fed is actively keeping them as low as possible. Second, inflation expectations may actually go up, as the economy reopens and the Fed continues to pump trillions of dollars into the economy. That means gold prices could be on the rise in the near-term.

That’s why we’re giving gold another look for your portfolio. Stay tuned.

Contact us if you’re looking for help with your portfolio!

Deprecated: preg_replace(): Passing null to parameter #3 ($subject) of type array|string is deprecated in /home/ogorek_dev_minerva/ogorek.minervawddev.com/wp-includes/kses.php on line 1805

PLEASE SEE IMPORTANT DISCLOSURE INFORMATION HERE.