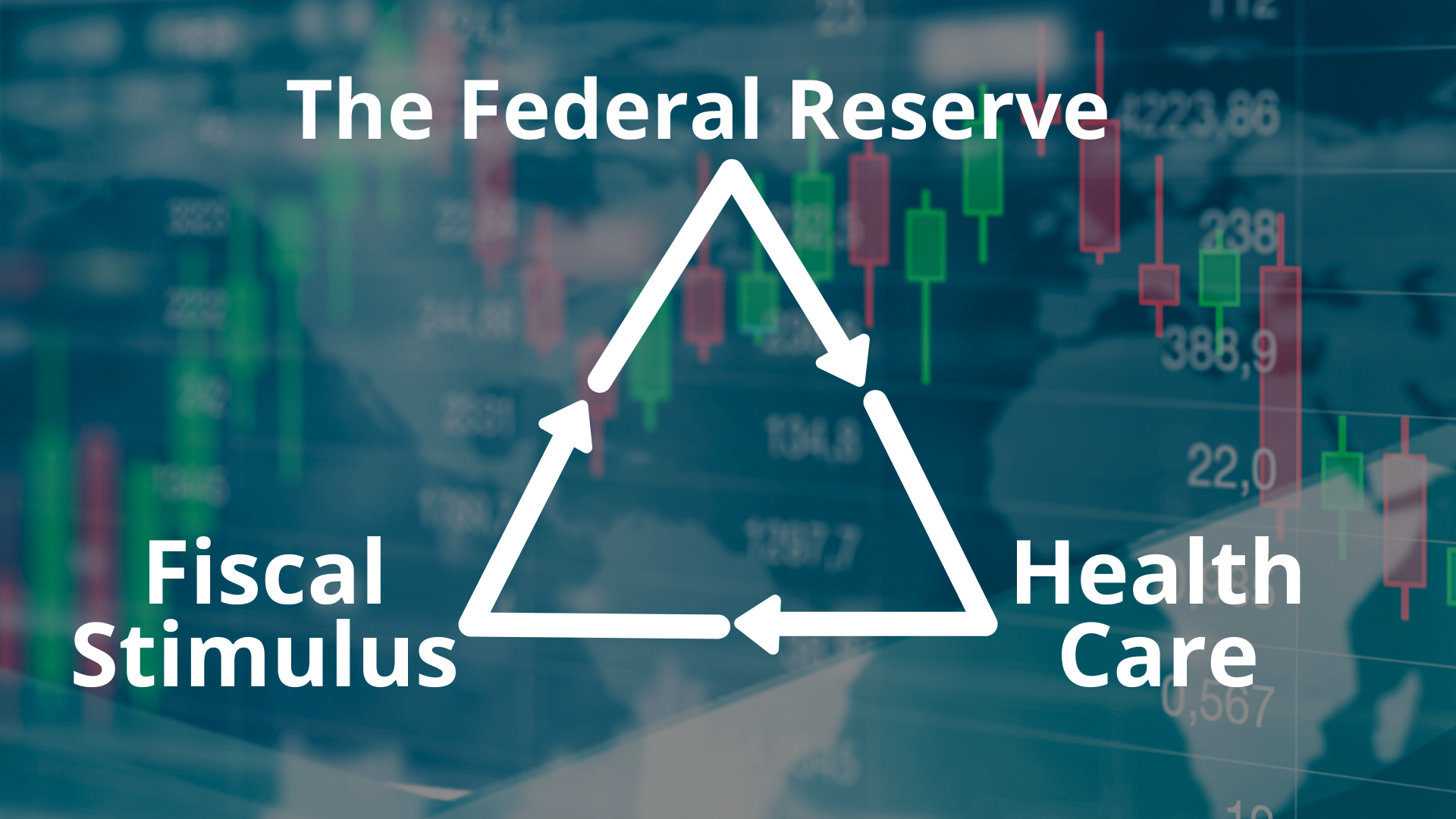

With the stock market powering up by 20% over the last 3 days, investors are asking whether this bounce can be sustained, or whether we are in for more pain in the future. We think the answer lies in what I call the Iron Triangle.

The Iron Triangle is simply a metaphor for three outcomes that the markets will require before they can begin a meaningful recovery. The outcomes are exceptional monetary and fiscal responses in addition to a bending down of the virus infection curve. Let’s take each of these points separately.

The Federal Reserve, our nation’s central bank, is charged with stabilizing our financial system by protecting the currency and controlling the money supply. The Federal Reserve Board is probably the most powerful, yet least understood, government agency. It promotes itself as the “borrower of last resort.” Congress has given them the power to create money out of thin air. This gives it the ability to provide unlimited support to the economy by taking steps such as backstopping the banking system, guaranteeing money market funds, and purchasing an unlimited amount of corporate and municipal bonds. The code word for all of these activities is supplying “liquidity.”

The money that the Federal government will spend on its various stimulus programs is referred to as fiscal stimulus. Congress is closing in on authorizing the spending of $2,000,000,000,000 in loan guarantees to large and small businesses, unemployment payments, direct payments to individuals, and medical support to help get the economy through this unprecedented economic shutdown. The government will borrow these funds via the issuance of Treasury bonds and bills. These borrowings will be added to the national debt. The combination of this unprecedented level of monetary and fiscal support, however, will not be enough to stabilize markets.

Since this is a health driven crisis, markets will need to see that we are effectively bending down the curve of people who have contracted the virus. Market volatility is not an indication of structural problems in our economy. Rather it is a reflection of the threat to the economy posed by the pandemic. The quickest way for our markets to recover is to control the virus. The stimulus programs are merely a bridge loan to the economy that buys us time for the social distancing strategy to bend that curve down and hopefully save our health care system from crashing. Any actions that interfere with this strategy will likely be viewed with a jaundiced eye by markets.

Deprecated: preg_replace(): Passing null to parameter #3 ($subject) of type array|string is deprecated in /home/ogorek_dev_minerva/ogorek.minervawddev.com/wp-includes/kses.php on line 1805

PLEASE SEE IMPORTANT DISCLOSURE INFORMATION HERE.